A lot of digital analytics focuses on direct response (conversions, leads, etc.). But there is an additional valuable, and sexy, focus of our marketing we don't give enough analytical love: Branding!

A lot of digital analytics focuses on direct response (conversions, leads, etc.). But there is an additional valuable, and sexy, focus of our marketing we don't give enough analytical love: Branding!

It is sad that we spend so little time on brand analysis, primarily because 1. there is such little accountability to brand marketing and 2. it is such a strategic part of any business.

So let's fix that problem in this blog post. Let's become BFFs with a lovely hidden gem that helps you leverage one of the largest source of data on the planet to understand the strength of your brand over time.

[Bonus One: Read: Brand Measurement: Analytics & Metrics for Branding Campaigns]

There are many different tools, both online and offline, that measure the elusive metric called brand strength. It's elusive because brand strength is, at its core deeply qualitative and none of us measurement types can really see inside your hearts and draw charts of the evolution of what's in your heart over time. So we use proxies, and we do the best we can.

One of my favorite tools to do that is Insights for Search which provides an incredible way to see how interest in your brand has grown over time and whether you are strengthening your brand over time.

Brand Strength via Unaided Brand Recall

Insights for Search sits on top of all of Google's organic search data from around the world. I believe it is one of the best possible ways to measure what humanity is thinking, and telling us via the queries they run on Google. I love using this tool to measure "unaided brand recall ."

The stronger your unaided brand recall, the more likely people recognize you, think of you, consider you when they need what you have to offer. I never search for a sports car. I search for the "best Nissan sports car."

You increase unaided brand recall by creating great products (its not called a tablet, they are all called iPads), delivering fantastic service ("their return process is as good as Zappos"), and of course online and offline advertising.

Sometimes it all works together. Recently I saw a TV ad by eBay for designer jeans. I typed designer jeans into Google (for that is what people do when they watch TV). The first ad was for Amazon. No eBay PPC ad or SEO listing showed up. Clever Amazon tying its online advertising with a competitor's offline advertising. Now I search for "amazon designer jeans." :)

For your brand Insights for Search provides an incredible way to see how your brand has grown over time, and whether you are strengthening your brand. If you strengthen it, you drive people to look for you (and not your competitors), and you can capture them more easily using Search (Organic or Paid). Brand queries, obviously, also convert better.

Leveraging Google Insights for Search

So over time, how's your brand doing?

Step 1: Type your brand name, and your direct competitor, into the Search Terms area of Insights for Search .

Step 2: Pick the right country, time period, and -this is important – high-level category in which your brand belongs.

Step 3: Click Search.

Step 4: In the middle of the resulting report you'll see a trend that looks like this:

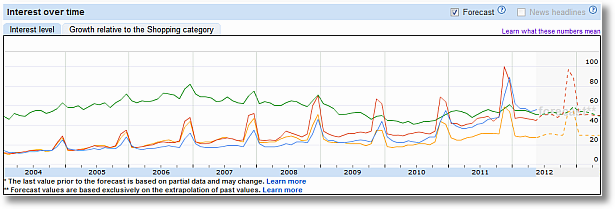

This shows the number of searches for your brand, relative to the total number of searches done on Google over time (for the geographic region and time period you've chosen). The data you see is normalized and presented on a scale from 0-100.

This is interesting. You can see that eBay (green) rose for a while but has been essentially flat. During the same time period Walmart (red), Amazon (blue) and Target (orange) have done exceptionally well.

But (as every Analysis Ninja knows) competitive context (above) is good, but industry/category context is even better! So…

Step 5: Click on the tab that reads "Growth relative to the Shopping category" and boom!

This is a lot more interesting. [Click on the above image for a higher resolution version.]

The graph shows the change over time, starting in Jan 2004. On the right axis you can see how each brand has grown over time in terms of its brand strength, in context of the growth of the Shopping category.

It is pretty amazing to see that even as eBay has massively ramped up its offline (including big TV) advertising, at least in this context its growth (unaided brand recall) has actually lagged its competitors quite a bit.

eBay's green line is very close the performance of the category (and you'll see that often at peaks in the shopping category queries, eBay actually does worse starting holiday season 2009).

The tussle between Wal-Mart and Target is interesting. It used to be cat and mouse, but over the last three years Wal-Mart is clearly leaving Target in the dust (just look at that spike during this past holiday season, omg!).

Amazon is an interesting example. It used to fall behind lag the other two in brand queries, but you can see how starting late 2009 (bad year for Target in this context) Amazon overtook Target and now (2011, 2012) is casting a big shadow over Target. For a real appreciation of how amazing this accomplishment is, consider the TV ads Target runs, the number of Saturday mailers it sends out, the number of billboards it buys, etc.

The above trend lines, when viewed in context of your category, helps you understand how well you are doing in terms of increasing your brand strength.

Do this analysis for your company.

Brand strength is important because when I type "ebay big screen tv" in the search field, I essentially eliminate everyone else. If I type in just "big screen tv", I'm going to Amazon (they just rank so well).

Brand strength is built over time using online and offline advertising. Brand strength is not built by playing a "let's bid on just our brand terms" strategy, but by complementing that strategy with a super-smart organic and paid "let's capture all our brand and category terms" strategy.

[Bonus Two: Video: Enhancing Brand Strength (and Avoiding Brand Destruction) via Social Media]

"Timing The Market"

One thing about Amazon looked particularly interesting to me.

You'll notice that Amazon's Christmas peak comes a few weeks after Walmart and Target. See if you can notice it here:

For Walmart (red) and Target (orange) this is not surprising. These are traditional retailers who have a fixed calendar of marketing execution with an overwhelming emphasis on Thanksgiving. After that, things ramp down.

Traditional retailers often have a fixed multi-channel schedule based heavily on past traditional media plans with less flexibility in being able to incorporate real time odd trends on the web.

But look at Amazon (blue), keep an eye on the highlighted time period above and look at this:

Notice they hit their peak exactly at a time when the Shopping category hit its peak! +25% in the first image above and +37% in one immediately above.

Amazon does such a great job that their brand queries also get an extra spike during that time, from +413% to +525%. You have to hand it to the Marketing folks at Amazon. When their competitors are ramping down (perhaps due to their inflexibility), Amazon can read the market much better (notice Christmas 2010 as well) and are well placed (thanks to Paid and Organic Search strategies) to grab all these new people who are coming into the market to shop.

And precisely at that time both their large competitors are rapidly ramping down their spend! You would think that with actual stores they would ramp up during December because Amazon is at a disadvantage having to use shipping!

Here's the link that should take you directly to the analysis in the images you've seen in this post: http://goo.gl/JbUzK

#rockbranding

Data? Check. Actions?

So what can you do with this data? How can you go and destroy your competitors? :)

I've written a comprehensive post with very specific guidance on how to leverage Insights for Search to identify actions. Please check out that post here: Competitive Intelligence Analysis: Google Insights for Search

In context of the above findings, I would focus on trying to identify the geographic locations in which unaided brand recall is stronger for my competitor(s) compared to me. I would use online and offline brand marketing campaigns to shore up my brand strength.

I would also focus on the very bottom of the Insights for Search report where you are able to see the cluster of search queries most closely associated with a brand (on the left), and the most statistically significant rising terms (on the right). They are full of specific insights you can use to optimize your online search campaigns.

Please check out the blog post above for more detailed guidance.

Five Caveats!

Life would be so much better if we did not have to caveat everything. But, sadly the life of an Analyst is imperfect. :)

Here are some caveats to keep in mind when you do this analysis…

1. This is just data from Google.com. So it just reflects what is happening with the share of people who use Google.com to find what they are looking for.

If I were doing this analysis in Russia I'd be using Yandex, in China I'd use Baidu, etc.

2. This type of analysis works best for medium to large brands. If you are managing a small brand, this might not be an optimal way to understand your brand strength. (Primarily a function of how this data is collected and processed.)

3. These are just brand queries. It is possible that brand zebra is really horrible at getting people to think about their brand, but they are so magnificent and awesome at getting people to visit their site via generic and long-tail queries.

Or you might hear brand zebra say "no one goes to Google since we primary use TV for advertising, they all go to our website directly." Or they might say "everyone in the world has bookmarked our site, no one would go to Google."

All good points.

To account for these objections/scenarios an Analysis Ninja should get additional context for the brand strength analysis done using Insights for Search. You already have the search behavior data, go get the overall traffic picture from a competitive intelligence tool.

I recommend running a report like this one:

I'm using www.compete.com above. You can see how this graph is wonderful context for what you did above with Insights for Search. Now you can answer those objections/scenarios.

4. This is but one (perhaps the most easily accessible) source of data for measuring brand strength. There are other ways to measure brand strength that are also wonderful. Primary market research comes to mind as another solid option.

5. I'm sure I've missed a caveat (this is a dangerous business!), please add your caveats in comments.

As Google Flu Trends has proven, online behavior is a very strong predictor of offline reality. I hope you'll do this analysis for your brand, get context from other data sources, and get your company to take very smart action in moving the dial on brand strength.

As always, it's your turn now.

How does your company measure brand strength/unaided brand recall currently? How cognizant are you of how your competitors are doing? Have you tried to use online data, like Insights for Search, to do this important analysis? What other caveats would you add to the four I've listed above when using this data?

Please share your experience, critique, examples, ideas and feedback via comments.

Thank you.

Via

Via

Con-grates me! I am first to put my comments on this (as usual) great post. :)

Very helpful, Avinash!

I didn't know you could look at brand term trending relative to the category, but immediately found a few helpful tidbits when I did the exercise you recommended. Now to block off more time to figure out what we did to drive the peaks and valleys.

There is an actionable insight in my future.

Thanks!

Thank you once again for your great insights, Avinash.

Personally I combine Google Insights for Search with Google AdPlanner when I want to get an idea of a competitors brand impact. The demographic insights help you analyse which kind of visitor feels the most attracted to this specific brand.

Ruud: This is a great idea. I do like AdPlanner very much.

In this context the difference between Insights for Search and AdPlanner is that the former is "observed behavioral data" of a digital audience and the latter contains "interpreted data" of the web audience.

So an example of actual observed data is: the queries people actually typed, the geographic locations they actually are at etc.

An example of interpreted data is the demographic and psychographic information about a person.

Not that the latter is not valuable, it is. But for this purpose I4S is a better.

-Avinash.

Really enjoyed this.

Does the Category filter include data from brick and mortar stores? If it doesn't, then the suggestion that we should see brick and mortar stores ramping up in December doesn't make sense.

Perhaps people are searching more for Amazon in their last minute shopping because they trust Amazon's last minute delivery (and they may not have the same faith in other online retailers).

Liz S: Let me see if I can explain the point I was making, and please do share your feedback if I misunderstood something…

My interpretation of the data was that if shopping queries are increasing very close to Christmas day then brick and mortar retailer would want to see their share of the queries go up, and not down. That's because unlike Amazon they have physical stores from where people can go and pick up the presents significantly more easily than waiting for Amazon to ship it to them.

But brand queries for Walmart and Target spike just before Thanksgiving (makes sense, loads of tv ads, weekend circulars, radio etc) and then they ramp down their advertising, causing a corresponding decline in brand queries. Given the overall spike (even bigger than Thanksgiving) prior to Christmas perhaps they should adopt a different strategy? Amazon's? :)

I hope that makes sense.

-Avinash.

PS: Insights for Search only includes online data, so the Category filter (Shopping in this case) does not include any offline (brick and mortar) data.

Insightful as always, Avinash, but I will quibble with you (respectfully, of course) on a few points: 1) I'd be willing to wager that Amazon's PPC ad ranked well for designer jeans for reasons unrelated to eBay's TV ad campaign, and will likely rank well long after that commercial has stopped running; 2) Similarly, I doubt the search for "Amazon" spiked at the same time shopping spiked due to any marketing genius on their part, but rather reflects the fact that Amazon and "shopping" online are increasingly synonymous; and 3) Target and Walmart spiking early due to retail push may not reflect a marketing mistake, but rather marketing priorities. It may be strong to say that what happens at Walmart.com is a rounding error on their P&L compared to what happens offline, but…the point is simply that Amazon's whole world is online, and for those with significant offline activity online may not be the priority.

George: You live and breath this data-set, having you quibble about the post is a genuine delight!

I'd the opportunity to look at some before and after and for that particular query and it was in response to the opportunity by Amazon. Clever. I wish everyone was that agile.

There is no doubt that you are right in the assertion that shopping and Amazon are synonymous. What struck me was… why was that "synonymousity" not showing up prior to Thanksgiving when it was well trounced by Walmart and Target. My hypothesis was that it was the overwhelming spend offline and good amount of online spend which was the stimulus. Then they turn the dial down, Amazon turns it up (at time when overall shopping queries also spike!). Two years in a row.

I concur that for both Walmart and Target the online component is negligible. I've had the privilege of meeting senior executives from both companies and they, rightly, love their stores. But to me leaving even a tiny bit of their flank open to Amazon is dangerous, they keep gobbling up more and more of the real estate. This week it is high end fashion. :)

On that last point…. When I met a massive traditional retailer last week the CEO said: "What happens if we do not action any of your five digital strategy recommendations for us?" My reply: "I'm sure you are going to be just fine and will likely leave in the next three years with a good retirement package. But your successor might be hosed."

-Avinash.

Hi Avinash, you say "Amazon turns it up (at time when overall shopping queries also spike!)." I tried to change I4S for just 2011 year for more detail and i can see it was Walmart and Target who reached the spike of overall queries between 20.11 – 26.11., not Amazon who had spike week after "Thanksgiving week".

But im not expert in US shopping habits and dont know if spike for Walmart or Target in that specific week means shoppers moved to offline shops in the week 20-26.11. or week later (then the drop would have sense, because they are shopping already, not searching online) :)

hello, one observation : lots of brands ( up to 50% of total advertising expendtire is non-direct, I believe ) are driven by System 1 thinking which is automatic and intuitive and relies of existing brand pathways reinforced over time. Typically a lot of these organisations in my experience use MR tracking to measure brand KPI's.

Search Insight is a very good way of measuring the 'actively searching' proportion of Zebra aware consumers. Many more Zebra aware consumers will exist outside if you like of this , as Search is System 2 thinking. So it can inform on trends but not actual population levels of brand saliency.

Similarly social media tracking can inform on mentions, sentiment etc etc as proxies for brand saliency.

Totally outside the scope of this post , one neat idea would be for a DSP whilst optimising for Daily/weekly 1+ Reach (reinforcing those pathways again) would automatically do a random TA online sample to check on maybe 1-2 awareness measures and maybe 4-5 key brand image measures. And link this back to the mix of channel pressure..In fact, if the system could also link to System 1 brand sales (Zebra units) a decomposition would tell you channel performance, and the intercept (which is essentially derived brand strength) aka mix modelling. A true dynamic model of AMS inputs ..

…ahem BUT the only caveat in this Alice in Wonderland is a mechanism to estimate digital and non-digital combined 1+ Reach.

On topic Caveat : suggest make sure that you understand the operational meaning of 'brand' from a business KPI point of view : Zebra ? Zebra Jungle Line ? Zebra Jungle Line for Children ? Zebra Jungle Line for Children Thanksgiving promotion ? Each will have a different level of saliency.

Mike: I agree, people who are on Bing, Baidu, Yandex are at the minimum "in the funnel." IE They've identified a need (top of funnel) or they are ready to buy (bottom of the funnel). In as much Insights for Search is a fantastic way to measure the strength of one's brand for that important population (one that is increasing over time).

As I'd mentioned at the end, this is but one source of data. MR tracking, Social Media mentions and Primary Market Research are other wonderful sources as well of answering other brand strength questions.

I love the suggestion to drill down on the operational meaning of "brand"! Thanks so much.

-Avinash.

Hi Avinash,

This is really wonderfull information to analyse how our brand works apart from rest of the keywords.

Also if you put some more information on AdPlanner, this will be useful for those who new to analytics like me.

Regards

Sam

Excellent, but with one flaw. Searches might come in due to a negative reputation or some unfortunate event. Or uncertainty about your brand.

Just look at BP versus Shell: http://www.google.com/insights/search/#cat=0-12-233-659&q=bp%2Cshell&geo=US&cmpt=q BP did not do an amazing brand the winter of 2009 -10 …

So one should seek to combine analytics with some form of qualitative data.

Kare: Ha ha! So true.

My assumption is that the Analyst would be smart enough to know that the rapid increase in Brand Strength is from sub optimal occurrences!

And one simple way to know this is to scroll to the bottom of the Insights for Search report and look at the actual keywords people are tying for your brand, that should give you concrete information about what type of brand mentions you are getting.

May every brand mention be positive for everyone! :)

Avinash.

Hi there,

interesting article, thank you. But we do this analysis to get to know if we done things in branding right in the past, am I right? To proof if our branding strategy works out. You proof it by compairing it to competitors. That's the second step in my eyes. First should be: How did my brandingcampaigns work out for me? I just miss the $-compenent. So what you think about just measuring this:

Direct Traffic to your Site + Brandsearchqueries (paid + organic) = Brandtraffic

So I just calculate:

(This years brandtraffic) – (last years brandtraffic) – (the average growth of the company in %) = (the brandtraffic you realy generated with your actual brandcampaign (which means at least marketing efficencie)). e.G.:

22.000 visitors per day this year – 12.000 last year = 10.000 – 30 % Ø growth = 7.000 visitors per day more from our markting campaigns.

Isn't that the thing ebay wants to know if they start that large TV campaign? (You get the $ by calculate with the Ø conv. rate of the brandtraffic of course).

Am I totaly wrong?

Matthias: Very interesting ideas!

I agree that this data is usually a few days old so it is at least a little bit looking back. But if your campaigns are running more than a couple weeks, this data can still be helpful (though as I mention in the caveats, you would have to be a big company or have a large campaign).

The analysis you've suggested (thank you!) is sound. We should all be doing it.

One small thing I would quibble with is the assumption that Direct Traffic is necessarily Brand traffic. It may be, it may not be. [Here's how I would analyze Direct Traffic: http://zqi.me/wadirect%5D

If you want to be sure here's a exercise you can go through, assuming your web analytics implementation is clean,… log into your Google Analytics and look at the Multi-Channel Funnels reports. Look at the Top Paths report and then look for rows with Direct in the path (use a in-report filter, usually on top of the table).

If you see Direct as the originating channel then I think we can possibly consider that that might be "brand traffic".

If you most of the Direct traffic in the middle of the conversion path or the last click before the conversion or places like that, then it is very hard to argue that that is "brand traffic." Simply because those prior channels (brand or non-brand) possibly deserve "credit" for helping find that visitor for you.

It is complicated. :)

Thank you again for your wonderful comment, and the helpful analysis example.

Avinash.

I agree with your thoughts, Matthias. One thing I particularly like about this idea about branding strategy compared to Avinash's (solid) tips is that, unlike I4S, small brands can use this method by setting up an advanced segment in GA.

Once you start segmenting more deeply, you can really start to measure the incremental benefit. For instance, suppose a business with operations in five cities is considering a media buy, and suppose they've experienced similar growth (or lack of growth) in two of the five geographic markets. Imagine they spend on a local TV ad spot in one of the two markets that have experienced similar growth trends for similar reasons. The company can compare the advanced segment in GA against the five geographic markets by looking at Location as the primary dimension.

Then the company can evaluate the incremental impact of the media buy/branding commercial on lift or customer lifetime value or new customers or whatever other strategic priority they've set. It's not a foolproof approach, but small brands can really benefit by this new intelligence about their branding campaigns.

Thanks Sean!

Great Ideas, looking forward to use this soon for our reporting.

Another great post. Thanks Avinash.

Is there a tool similar to Compete that can be used in the UK? I have uses Google insights but would love to get my hands on something like Compete. I know if Hitwise but would love to find out about other options.

Thanks

Indu

Indu: HitWise is a great option if you have access to it. Additionally you could also consider using Google Trends for Websites or Google AdPlanner.

-Avinash.

Thanks for your post.

The biggest question I have is regarding smaller companies. For example, I help with marketing for a specialty coffee equipment supplier. We believe ourselves to be fairly well branded in specialty coffee, but it would be nice to get actual insights into our branding.

Unfortunately, overall, we don't really show up for insights for search (and aren't able at this point to put $199 per month into Compete.com) so it's not an accurate estimate of our branding to our actual target audience.

Do you have any suggestions for how a smaller company, similar to ours, could better identify brand reach?

Thanks!

@Kirk

You have to be a bit creative in this. First identify your core product or service. After that, see what kind of trend Google Insights for Search gives on that keyword.

Compare this – for the same period – with your keyword data in Google Analytics (preferably via an advanced segment with your brand related keywords; i.e. company name + product or service).

See if you notice any similarity in the trend.

I agree, it's a bit a workaround, but it should give you valuable insights.

Ruud, I really appreciate your help. I'll be thinking through your suggestion. My initial thought is that this will also be difficult to do since our core products tend to be highly competitive, industry standard products. In other words, searching for "True Commercial Refrigerators" in Insights for Search shows what we AND all of our competitors are doing with that, but it doesn't help us grab trends that we specifically are doing.

I hadn't thought of this specifically, so I'll keep thinking through whether this will help, but my thought is that we are still unable to determine our own specific brand reach when our "core" products are so competitive and market-saturated.

I do appreciate your help though.

Ruud, I apologize. I reread your comment and realized I had initially missed your suggestion to compare that with our own trends & branding. That is intriguing. I will give that a try. Thanks, sorry I misinterpreted your comment originally.

Kirk: The way competitive intelligence tools work is that they "remotely" listen to all kinds of signals on the web (using panels, logs, self collected signals and more) and use that to approximate what is going on. In these scenarios they need a lot of signals to come up with decent data.

The problem for small sites is that the number of signals is not sufficient, and the strength of those signals is weak. That makes is difficult to be confident about the data provided (and hence many like Trends for Websites or Insights for Search) simply don't provide that data. Rightly so.

If you are a small company you still have two options:

1. Analyze how the industry/category is doing. Insights for Search has three level drill downs for categories. Learn from big industry trends (people, geographic, interests) and use that knowledge to plan your strategy.

2. Analyze your big competitors directly. Use their data to become better, use their data to go after them. :)

-Avinash

That helps, thanks!

Wow, what an epic site. Pure awesomeness.

I have bought your two books and now not sure where to start reading? :o

Not to mention this blog :/

Rehana: Please read Web Analytics 2.0 first. I think it is the best way to get the optimal grounding.

Then stay in touch with the blog for the latest stuff.

Finally, go back to Web Analytics: An Hour A Day for the pieces that are not covered in WA 2.0 (a bunch of stuff like process etc).

Avinash.

Fabulous! Will do that, sounds like a plan to me. Ta Avinash.

Great tactical article. The challenge (as you mentioned), is gaining data on small brands general market penetration. Or even contextually within a particular category, if the search volume is low.

Couldn't agree with you more. Brand doesn't get enough focus.

Used the *insights for search* tip for a few projects I'm working and the results were fascinating. Gonna free some time next week to implement this into client strategies.

Thanks alot.

Great article!

I think that alot of times people overlook their brand or their brands reputation. People seem to be caught up in ways to drive traffic to them, but if you build your brand then you will be found more reliable to consumers.

For an interesting perspective, look at the search trends for "Kaplan University" in Google Trends over the past several years.

In January 2009 they ran a huge TV campaign apologizing for the state of affairs in the education market. While there was a spike in search traffic during the campaign; there appears to have been a lasting impact through out the year since search never returned to the prior levels.

In fact it stayed substantially above the pre-campaign level and the pattern repeated itself the following year when the campaign was refreshed in 2010.

However, it has now eroded back to 2008 levels. It seems branding isn't permanent.

Avinash,

Your blog rocks, thanks for these nuggets of digital wisdom!

Do you have any suggestions on where to find publicly available benchmarking data to measure blog success? At Teach for America, we recently launched a blog initiative and would like to see how the traffic, RSS subscribes, social sharing, etc. compare to other blogs out there. The benchmarking report is no longer available in Google Analytics– have you found any alternative resources?

Thanks,

Sara

Sara: I'm afraid I don't know of benchmarking sources that make it easy to get this data. But here are some ideas…

There are some sources like the AdAge Power 150, Marketing Blogs, ranking that collects a bunch of data (most of what you mention below except traffic), but I don't know how many blogs there you might consider competitors. Perhaps you can "steal" the way they collect data. :)

It is not as sexy any more but Technorati provides the latest time period ranking for any blog whose url you can type into the tool. Sadly they don't share trends, but it is something.

Finally there are tools like SocialMention that might provide a good way to gauge "social ripples" caused by one's blog (and one's competitors).

I hope these will get you going in terms of creating a set of benchmarks for TfA!

Avinash.