There is perhaps no challenge greater than tracking offline impact of your online presence (campaigns or other activity). It is perhaps one of the last few complex nuts left to crack.

There is perhaps no challenge greater than tracking offline impact of your online presence (campaigns or other activity). It is perhaps one of the last few complex nuts left to crack.

Why? Because it is hard. Not impossible. Just hard. And for now it is equal parts quantitative, qualitative and faith.

This post bravely attempts to:

1] Highlight the importance of holistic multichannel analytics

2] Outline why online to offline tracking is a difficult exercise, atleast for now

3] Provide you with a bushel of specific multichannel measurement ideas to help quantify the offline impact of your online presence

It's a tall order, but after two years of blogging why stop now. : )

Why should you care about measuring multichannel impact?

You have a delightful website, it is chugging along merrily at a 1.7% conversion rate (average as reported by shop.org) and you are dutifully reporting our revenue of $1 million as a result.

Happiness?

No.

While you might be doing great in terms of direct revenue impact of your website, pause and consider what in God's name is happening to that other 98.3% "unconverted" traffic on your site?

It is quite likely that your website is delivering some value to that 98.3%, how about quantifying it? Ok ok some of them puked and bounced. But the rest probably got what they were there for and your website was helping them by doing all those "jobs" as well, along with pure ecommerce.

Your ecommerce website is helping people who will only do research online and then buy stuff in a store. Its job is also to provide information to people who want to learn and then call your phone center to buy.

Or just submit a lead and have you call them. Or there are people who will get their tech support question answered and as a result not call you on the phone (saving you $50 it costs you to answer the phone). Or help someone learn about your company and then apply for a job (saving you $2,500 in recruiting cost per person!). Or. . . .

There are many jobs your website is doing, it is your job to measure the holistic impact. In blue below is the typical direct conversion impact and in red it a very large area that we almost always ignore quantifying. . . .

It is quite likely that by the time you quantify the impact of your site on the 98.3% Visitors it turns out that the site delivered $4 million in value (which dwarfs the $1 million in direct value).

That's why multichannel analytics is so important.

You struggle to get budget to hire Analysts or Marketers. Your head is sore from banging it to get funding for a new CMS. Your hair is thinning from repeatedly trying to get funding for online campaigns. Ever thought that you might be making a case from the wrong base ($1 million impact)?

The effort you invest in measuring offline impact will finally help your company understand how valuable the online channel is (or not!). Do it.

Framing the online to offline "data" problem:

Why is quantifying offline impact such a problem?

Two words: Primary Key.

In English: We simply don't have a way of joining the online data to offline data.

What do I mean by that (to those of you who are not database geeks)?

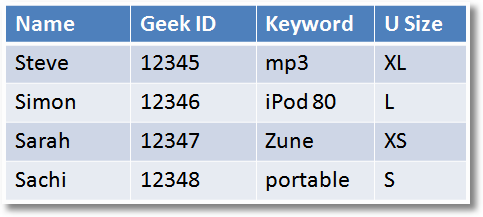

Here's your online data:

You are capturing the above information using your web log based or javascript tag based web analytics tool. Name, a unique persistent customer id (Geek ID), the keyword the person came on and their underwear size. Well just assume. :)

You also work at a large retailer that sells stuff cheap and when people purchase at your big box store you collect this information:

A unique persistent customer id (which the customer kindly forks over), the product purchased by the customer and the store at which they purchased it.

The two tables above have something in common, a primary key (Geek ID).

This means we can join the two tables with simple sql and understand which online shoppers ended up making a purchase offline (and what keyword they used to arrive on your site):

Boom! Nirvana!!

You know exactly how much online contributed to offline sales, you know how to optimize your online campaigns (buy Apple iPod terms to increase Microsoft Zune sales!!), and if you want to predict (after collecting enough data) if underwear size has a causal impact on what digital music player people purchase.

All this made possible by a simple thing, yes the Geek ID, the primary key.

The problem? [Cue sound of a balloon deflating…]

Usually no such thing exists in the real world.

For almost all the websites today the data that is collected is unique to online only, it is non-PII (personally identifiable information) and anonymous. When people visit our stores, call our phone centers etc, and ring up at our registers they give us their credit card and their names etc but not, as an example, their unique persistent cookie id.

There are small exceptions, like banks where your offline data can be tied to your online behavior using the primary key of bank_account_id.

But usually: No cookie_id = no primary key = no soup for you!

Still some web analytics vendors and consultants are fond of saying, "Yes we can track everything, online and offline and underwear sizes, and you won't have to lift a finger!".

Next time you hear that ask them in a sweet voice: "What is the primary key you use to join the two online and offline data?".

Get your surprised look ready! : )

But. . . . hope :

The path to hard quantification between online to offline is littered with obstacles, for now, but it does not mean you can't track anything at all (unlike say your TV campaigns!). The current obstacles simply mean that you'll have to get a little creative, be a bit thoughtful and show a willingness to make a few leaps of faith.

If you are willing to create a small portfolio of initiatives then you can get a pretty decent understanding of the hidden impact (offline) of your web presence. Pick a few different correlating data points and you will be surprised as to how far you can get in this game!

In the longer term in corporations data won't be quite as siloed as it is today, maybe consumers will be willing to share more of their PII data with companies (though I admit I am not budging with my privacy settings!), or perhaps magically we will have the primary key we need.

Either way it might be less of an issue in a few years, be hopeful.

But also be pragmatic, about how much, how accurate and when. Right now, yes today, try some (or all) of the things immediately below and make progress.

Tips for measuring offline impact ("conversions) of your online channel:

Some of these you might have heard of before, others might be new to you. New or not, with each my hope is to provide bonus tips and ideas that I think will be new to you. Let me know if you find that to be the case. Here we go. . . .

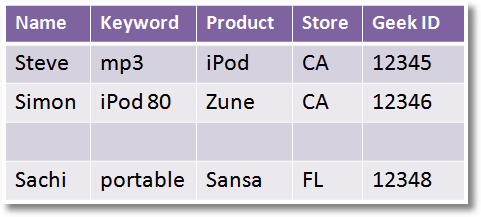

#1: Track your online store locator, directions, other direct offline dimensions.

I can't believe how easy this one is and often people don't value it. You have stores, you are smart enough not to hide your store locator on your site, you have integrated with Google Maps and hence now it is time to track usage of the store locator as a proxy for driving people to your stores.

First thing to do is track how many Unique Visitors (or Visits if you are so inclined, Matt!) are using the store locator in a give time period.

![]()

It is not that hard, check out the Omniture report for the above url and bam (!), a hint of offline value delivered by the site.

Bonus Tip :

Oh and if you want to get a smidgen more value, configure the store locater search parameter in your internal site search and bam bam (!!) you have a bit more data (what geographical areas have people that have a higher tendency to use our website). In the case of walmart.com (above) that would be the "sfsearch_zip =94043" parameter in the url. You boss will be impressed with this additional set of insights.

But wait there is more. A little more. This guy….

If people use the maps and directions feature in your store locator feature then they are showing a higher intent to visit the store (else they would have bounced long ago!). Track it!

After I go through the pain of typing my address, doing next, next, and getting the directions I end up here and. . . .

![]()

. . . . and you have one more page in Omniture you can configure to compute customer offline intent (THDStoreFinderDirections baby!).

See how easy that was, a medium sized intent by measuring usage of maps and a strong sized intent by measuring customer offline intent.

Bonus Tip :

But don't stop there. You have already identified these two buckets (location, directions) in Omniture (or in Google Analytics!), that took ten seconds. Now segment the Unique Visitors (or Visits) that display offline intent by referring urls or by email campaigns you are running or by search keywords or affiliates traffic or …. the list is nearly endless (a very good thing).

You now understand what online activity you are doing in terms of acquisition that is driving the kind of people to your site who are displaying a strong intent to visit your stores. Happy birthday!

#2: Use unique 800 (toll free) numbers on the website.

1-800 numbers are so cheap now that our local phone company sends us a free one when we sign up for a home phone line. Each person who calls us on that number is something like 7 cents. Really not a big deal.

So on your website use a unique phone number that is not available through any other channel.

Now track the calls to that 800 (or whatever) number via your phone (PBX) system and you have another signal for the calls driven by your website.

This is very effective for many kinds of websites, be they ecommerce or technical support or lead generation or whatever else is your quest in life. :)

On your website if your phone number is well hidden (like on most tech support websites, #$%@*&!), then using IndexTools or ClickTracks track the views of that page. Gives you something to correlate to your call center (PBX) data.

Bonus Tip :

Are you using unique phone numbers for your Paid Search landing pages? A quick Google search will yield a ton of companies that will put a unique phone number on all your landing pages and will only charge you when people call that number and will give you (in some cases) the data you need to track offline conversion information (by every single keyword / campaign!).

If you are spending "a lot" on AdWords and AdCenter, this can be a excellent add on to track conversions offline due to your Search Engine Marketing (SEM) campaigns. Obviously it would also work for all other kinds of online marketing you are doing and allow a very deep level of accountability.

Bonus Tip :

For a extra cute level of tracking why not let your phone system "ping" your web analytics tool so that you can track the phone calls generated by your website directly in WebTrends or CoreMetrics or Google Analytics?

A quick "hidden page", a small chq to Mongoose Metrics, add campaigns tags, and now every time someone calls that number it pings your site, the phone call data shows up in your web analytics tool. Nice ain't it? Check out: Offline Phone Call Tracking With Web Analytics Integration.

So you see there are atleast two simple things you can do that will greatly extend what you can do with good old phone number, needs a bit more elbow grease but nothing worth having in life is easy. Right?

#3: Use unique coupons, offers, promotions online.

Not that hard. Use unique prices, promotions, coupons etc in your online marketing and then track the redemption of these through your offline (phone or retail) channels.

[Yes I am using the Starbucks coupon as the example, yes it is ironic.]

Regardless of the redemption rates of coupons, many businesses find them to be very effective at tracking conversions offline. Not all online offers have to be fiascos (like Starbucks) and if they offer something partly of value they can be great at driving store traffic.

That last part above is important, something of value.

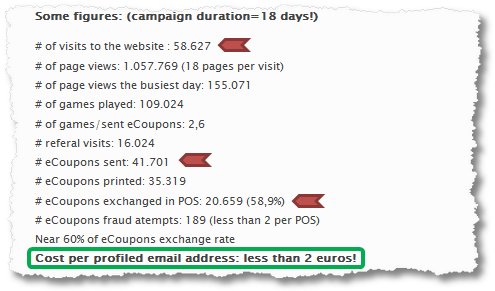

My peer Rene at OX2 showed a great case study with their client Panos, it shows measureability of coupons. Here is a picture from his excellent post :

[The emphasis with colors is mine.]

They measured "impressions", "interactions", "impact" and "income". And they measured "fraud"! Not too shabby.

Of course you are also executing the oldest trick on the book: Send *unique* (single use) coupon codes / promotions to the relevant people on your email mailing lists and then track redemption of those coupons on your website, call centers and stores. For one of my clients the insights were astounding. The website conversion view was just a third of the picture! But what was most amazing, and it was amazing (!), was understanding the channel preferences of our customers. For example the young 'uns went to the store and those born earlier preferred the website. What was up with that?

That example just shows how you can not only measure the complete conversion picture but also take a stab at understanding customer behaviour (remember for email lists you likely have their locations and demographic info and history and all that!). Try it, it is a lot of fun.

Bonus Tip :

Many companies are now targeting their offers and coupons to just Visitors with repeat visits or people who are in certain geographic location or for just certain products or at just certain hours (day parting!). All these methods provide excellent options when it comes to then measuring the value of online traffic (because rather than the generic catch all, the impact is siloed and makes it easier to assign attribution).

So you don't want to give money off, that's ok. Why not do a soft launch of a particular product, only "announce" it online, and only offer it for a limited time to people who visit your site from certain Geography (or campaigns). See if they then go buy the product in the stores. A great example of promotions vs coupons.

Or Tweet the promotion and see if people rush to the store. How hard was that?

#4: Marry / mine online and offline data.

It took this long to get to this "basic" idea, its because it is not that basic and is usually available only to a fraction of the companies out there.

This marriage can be tough to accomplish, but is totally worth it and amazing.

In our non-line world, example of could be Lucky or Safeway supermarkets. They both offer the ability to create an account online, they ask for your "club card" (the one you use to get discounts) when you set it up.

Now when you visit the website repeatedly (and of course get the actual physical stuff in the store, still no "virtual food" to keep you alive!) they collect data on you that they can, with a small effort, tie to your offline behavior.

Another great example of this what WalMart is doing. They offer 100% ecommerce but they allow the option of home delivery or pick up in the store. Sounds convenient.

But the sweet thing WalMart is able to do is not only track that you picked up the item in the store, but they are also able to track (even though it is a separate transaction!) all the other "stuff" (chewing gum, nachos, 39" tv) that you picked up when you were in the store.

That is a excellent way to quantify the incremental lift that the online presence is driving in the stores.

Is your business measuring the chewing gum effect?

Bonus Tip :

Another thing that we did was to marry up the data for those Visitors who purchase online with their past historical data that we had in the company. In our business people would buy or upgrade each year (or every other year). Having their order data (name, address etc) from the online data store merged with the offline data store (which also had name, address etc) allowed a richer understanding of "channel shift" and other macro patterns.

#5: Leverage onexit online surveys (or Point Of Sale surveys)!

Enough of all this quant stuff, let's truly use web analytics 2.0 !

Why not just ask the people (on your site and in your store) if your web presence had a net positive impact on them?

Just ask.

And they will tell you. :) No guesses.

You have a onexit survey on your website? No? Yes?

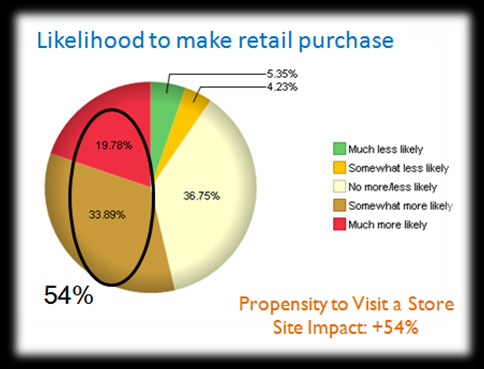

Well if you don't then get one (4Q is free and a great start.) If you do then add a question to the survey, the question will measure "likelihood to buy offline" or "likelihood to visit a store" or . . . you get the point. . . .

All survey providers will give you this option in a heart beat. iPerceptions, crmmetrix, Foresee, WebIQ etc. In two heart beats (ok a couple weeks) you'll have data like the picture above. Real multichannel impact of your website as rated by the people you are trying to impact: your customers .

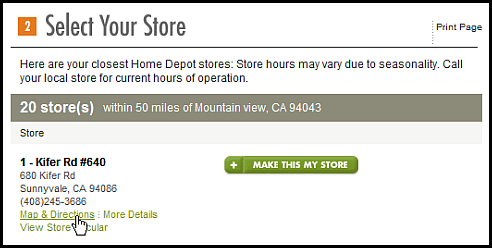

Another great idea is what I see at CircuitCity stores. They use point of sale surveys, what a novel idea! When you purchase a something at a Circuit City store you will notice you get a long receipt. That's because at the end of that receipt there is a request for you to fill out a online survey at www.bizrate.com.

The goal of the survey is to understand your shopping experience and various attributes that lead to that purchase, including how the website might have played a role.

The results are there for people to see on the website, but more importantly the detailed survey analysis (including open text VOC) that BizRate hopefully provides are the real gold mine of actionable insights. And yes it will help you quantify the value of not just the online channel in terms of driving traffic to the store but also if it was more qualified traffic or better educated or ways in which your site might be failing your store shoppers.

Bonus Tip :

Trend and segment. Really.

The true value of running surveys as a listening mechanism is that you don't treat them as one night stands. There is some fun in that, but meaning is only created by longer term engagements. So have this as a continuous listening methodology, always on (and remember you can sample a small random number of website visitors and that is enough/ok).

This allows you to trend data over time and see how the website is getting better or worse for those (a majority!) who will not buy / transact online. You can also then isolate evolving needs of your customers and impacts of seasonality and other such factors.

And I'll stress segmentation again. You are asking the Primary Purpose question already ("why are you here"), now segment likelihood to buy offline by those tasks – are you solving for one group of visitors better than others? Segment by products people might have looked at, segment by new or returning visitors, segment by campaign traffic and direct traffic and on and on.

Seems like some amount of work, but if you are asking the right questions in your onexit survey this is really easy to do, and the best of all your survey company will do all the work. So… do it, rather make them do it. : )

#6: Conduct controlled experiments.

This is a technique our peers in the offline world have been using for time immemorial, and we in the "advanced world" seem to be totally ignorant to it. Quite sad, because it can be awesomely cool.

What is it?

Do you notice why you can buy some products in your favorite store but when you are on vacation and visit five other stores in different places you notice that they all have a slightly different selection.

Or when I first came to California I noticed that in Mountain View they had a fast food outlet called Border Bell. It strangely looked and felt like Taco Bell but the selection was different, they served fresh salsa (three kinds!) and I loved it. But I could not find Border Bell any place else.

Both are examples of companies running controlled experiments to validate their ideas in the real world by running experiments (sadly Border Bell did not make the cut, it is now a Taco Bell).

Take that as your inspiration (not the failure of Border Bell part, the controlled experimentation part).

You want to see if your website can drive traffic to your stores? Do a email campaign to your customers in Florida, Iowa and Oregon, drive them to your site to learn more, and see if that causes a lift in store visits to Costco (your co-branded partner).

Or run PPC campaigns that are geo targeted to deliver a certain message / call to action on www.google.com to potential customers in California, Michigan and Georgia. Measure impact on your site, correlate it with any signal you pick up in your call center.

Or for a week don't send newspaper inserts (yes those things that go directly into recycle bins) in Arizona, New York and Indiana and run banner ad campaigns on related sites and drive people to your website to look at relevant and unique campaigns in their zip codes. It's an experiment to see if you can drive the right kind of traffic to your offline channels.

And on and on and on.

The core idea is to try something targeted so that you can correlate the data to your offline data sources (even if you can't merge it) and detect a signal (impact).

By isolating it to different states (that are far from each other) you are isolating "pollutants" to your data (things beyond your control that might give you sub optimal results).

It is not a perfect methodology, and it takes time, and it needs you to be of decent size (or have enough impressions / customers) to quantify the impact. But few things will give your more confidence in the results you find.

Bonus Tip :

Before you say it, :), correlations don't imply causality . So if in doubt, rinse and repeat.

#7: Primary research baby!

The second technique that I have learned from our well established offline brothers and sisters. Good old fashioned market research to isolate the impact of your online presence on your offline channels.

Field surveys, focus groups, interviews and more.

Let me give you a example.

Twice a year a tech company collects the names and info of all the folks who purchased something, online or offline or non-line. It then sends that information to their market research agency who, using a portfolio of methodologies, polls those customers to discern all the drivers that caused that purchase.

The data was a gold mine of information related to product attributes, the television ads, the website, impressions from visit to a store, percent of people who touched multiple channels before they purchased the product and so on and so forth.

The survey was done twice a year and, as stressed above, it was a continuous listening methodology and hence it provided a nice series of trends and segmentation data.

I remember the first time I got someone to pay some attention to the website in that company.

![]() It was not my constant on the knees begging.

It was not my constant on the knees begging.

It was a slide (one slide!) in the analysis deck that showed two pieces of data (both as a pie chart :)), that 24% of the ultimate purchasers (through any channel) listed the company website as the most trusted source of product information and secondly that 40% of the purchasers used the website during the purchase consideration process.

That got me money for Analysts, and that got the poor starved web team two resources to improve the website. All from one slide.

But that's the power of data.

You can think of many different ways in which you can use these kinds of approaches and how they uniquely apply in your case.

Bonus Tip :

I tend to think in terms of a portfolio model. No one method might be perfect or God's gift to you. But a couple, or more, of the techniques above will help you get a robust understanding of this hard to solve problem. Combine that with things you are already measuring as a part of your web analytics 2.0 approach and you are sitting pretty.

Good luck!

Ok now your turn.

How are you solving the problem of tracking online to offline tracking? What has worked for you? What did not? Have you tried any of the above? Does anyone believe your analysis? If you could pick one thing to try, which one would it be?

Please share your stories and wounds, and for that we will love you just a bit more. :)

Thanks.

PS:

Couple other related posts you might find interesting:

- Eight Tips For Choosing An Online Survey Provider

- Excellent Analytics Tip #13: Measure Macro AND Micro Conversions

- Stop Obsessing About Conversion Rate

- Seven Steps to Creating a Data Driven Decision Making Culture

- Emetrics Summit Reflections: Peacocks, Woodpeckers, World Bank, Lifetime Value & Click Fraud

Via

Via

Interesting post however, I don't think that true multichannel measurement can work in all sectors. Financial services for example (and I spoke about this very think at a Marketing Analytics Conference in London) has to deal with ancient systems, which truth be both are slowly getting replaced. These systems are notorious for being impossible to get meaningful data out of them.

In an ideal world we would be able to easily match internet banking id back to customer id and then also tie that back to their bank accounts and therefore analyse their branch, telephony behaviour. However, for many reasons this is not happening. Firstly, the channels themselves are measured in silos, secondly there are political issues which always seem unsurmountable, thirdly there is the question of resource and cost – SBUs would be asking what is the benefit of spending this money and how are we as a channel going to benefit from it. So essentially whilst the customer is 'shared' across all channels, the channels compete for the customer's attention.

Even by using multiple primary keys you are still running into the wall of – is this really generating any value to the channel (note – NOT the brand).

Your sense of timing is impeccable Avinash, I was going to e-mail you about this very topic. Basically, I was messing around with jaxtr (www.jaxtr.com), which by the way, is absolutely amazing for long distance calling now.

If you're not familiar with it, Jaxtr essentially allows you to use a VOIP network and pair the number with a landline, cell phone, etc.

Phone numbers are generated by typing in the number you want to dial and pressing call me in a Jaxtr applet, which then gives you a local number to call which routes to whatever phone the individual has set up.

I was thinking that, for analytics, this is a god send. In your local market you could set up an online campaign and have people call the telephone number assigned by Jaxtr, which would be specific to your online/offline ventures and the long distance rates are literally around 1-2 cents a minute.

Another useful way to connect the phone calls your web site has generated is by using a one field form: "write down your phone number and our representative will call you back instantly"

Its simple, It works, It gives you all the info you need on that visitor (referral, keyword…, it also saves a few cents to the visitor.

Disadvantage: as you all know, many people don't like to give out their phone numbers and you probably should also give them a phone number they can call (now you are looking at incomplete data)

Bonus- send the representative other types of info that you have captured in the visitors cookie, might help the conversion.

Amen Avinash!

At Nordstrom, we used the type of tools you describe to demonstrate that we were essentially missing at least half of all conversions by looking only at the online channel — the other half of the conversions happened in-store.

Imagine how your campaign ROI changes when you add the offline conversions to your calculations?

We developed Multichannel Forensics to understand the very dynamics you describe in this post.

Good job!

Welcome back Avinash. You were missed.

This is a spectacular post, it takes something that is quite opaque and makes is transparent, exciting and achievable.

In my company we have done the first few things you mention but have not tried the last three techniques you mentioned. They seem, in classic Avinash fashion, simple yet powerful.

Thanks!

Great post, I like voicestar for offline tracking – they allow you to swap images and text phone numbers right form their interface. The fact that their reporting has an API helps you move the data from one place to another (your web analytics dashboard) easily.

Truly insightful, I'm just amazed at how ridiculously simple this sounds yet in the boardrooms we tend to think that the internet is this magical world in which we expect instant "useful" data with every click **poof!** especially when trying to connect dots. Funny how if you only look at one dot (your online activity) there's not much to connect.

Proof positive that even with this massive amount of data both online and offline, it still takes an Indiana Jones-like-approach to getting the job done. Time to get my digital whip out and start rounding up some analytic treasure. Thanks for the hefty post Avinash! Glad to see you made it back.

Stefan Holt

http://www.acktivemedia.com

Very interesting. I like how you show the Store Locator and Map links is a decent indicator of offline intent. It's simple and effect.

Although I'm curious about Mongoose Metrics. If you use a phone call to register a page view, aren't you distorting your traffic stats?

This was a wonderful post to read — you always have a storyline :-). My 5 cents on multi-channel analytics (used to be 2cents — you can blame the inflation).

I am a 'fanatically' strong proponent of multi-channel and cross-channel analytics. To me this is the only way one can get a holistic view of your customer's experience with your company (and here I am going beyond looking at the impact of your website; one should at least strive to look at the total impact of each channel because the way we might be driving some customers from the website to other channels, the reverse can also be true).

The crux of the matter (as you point out) on whether one can do multi-channel analytics comes down to the issue of if the data from the two worlds can by married/synthesized or overlapped. And I think there are multiple ways to skin this cat. In one of your 'Bonus' you mention matching the contact information — this is really a great way to bridge the online/offline world in cases where you don't have a common id or account number (either do it in-house using something like SAS or outsource it to folks like D&B or Acxiom who thrive on matching. The advantage of the latter, albeit costly, is that not only you bridge the online/offline world but you also now have the demographics/firmographics on your customers).

And lastly, multi-channel analytics by itself is not the nirvana. To me it is the 'dissemniation of the results' from the multi/cross channel outlook that really gives you an insurmoutable competitive advantage. To this extent, I am guilty of favoring the pub/sub infrastructure model :-), where each channel can publish the information about customers coming from their channel and the other channels (if they want to) can subscribe to relevant pieces to provide a more delightful experience. As an example, if I am a rep at the customer service picking up a call from Customer A, I would love to know beforehand that Customer A just went to our website and was searching for Product A — I can be better prepared and can proactively help the customer. Even if you don't have this infrastructure, one can still set up an info-exchange process across channels using a simple protal.

Anyway, a great topic and a great post — and a topic that can be debated at length :-).

Sometimes you don't actually have to have the same id's to get good results. Taken aggregate you can look for patterns. Take online banking for example. Say the bank didn't offer the ability to set up automatic payments online and you had to call the call centre. After adding the feature online you can then measure the overall drop in call centre requests for this type of transactions and the increase in use of the online version to get an indication of how this feature is working. By tweaking the online version (usability, visibility, etc) you should be able to reduce the number of calls to your call centre and reduce costs.

Non of this requires linking ID's but it does a good job of measuring online/offline interaction.

Avinash,

Great topic and great post!

I have a couple of scenarios to throw in the ring. Some retail sites, like bestbuy.com, provide users with the ability to post reviews on products provided that they have logged in. If somebody posts a review and had to log in to make the post, you should assume that they have purchased the product. If they logged in, posted the review and you have no online purchase history for that product from this user, you might be able to make the assumption (leap of fath jump) that they came into the store to physically make the purchase that they are now reviewing. Their product review is going to influence future online and offline sales. I understand that it is entirely possible that they purchased the product at a competitor and are posting on your retail site, but I would think if they have an ID and post reviews, you have them as an engaged customer.

The other scenario I wanted to throw out there is that I've seen instances where companies demand that you register on a site before you get to print coupons. When you print the coupons, your logonid is encoded cryptically on the coupon you print…maybe on the bar code. It's not a static coupon, but a dynamically created one…just for you! When you go and redeem the coupon, the redemption company reads your user ID off of the printed coupon. Then, the link can be made the confirm that user johndoe123 printed the coupon on this day and redeemed it 4 days later at a specific store. Now we know where johndoe123 shops and redeems coupons. I had a retail superstore send me directly a coupon discount card that had a list of items that I could get on sale if I presented the card at the cash register. It also had multiple bar codes on it. Since it was mailed directly to me, I'm suspicious that they were tracking me in their system in much the same way.

Just a couple of other ways to track online and offline conversions.

Everyone: The problem with midnight blogging is that one forgets important things. I forgot an important recommendation on this topic.

If you want to get very good at the multichannel game then please allow me to recommend the book Multichannel Forensics by Kevin Hillstrom (he is far too modest to do it himself in his comment above). It is a book for anyone who wants to be serious about truly understanding multichannel customer behaviour.

Kevin came from the "traditional" catalogs and stores and direct marketing world, which gives him a unique and informed perspective on how to solve this problem.

The book is worth every dollar it costs, and then some.

Miles: I was certainly thinking of entities such as banks when I was outlining the challenge of online to offline tracking. For all the reasons you mention.

But I believe that all other techniques, except #4, apply to banks. I don't think that they realize that they have all these options, that will take a fundamental mindset shift that perhaps will take a generation.

Nonetheless they can apply the techniques and start to truly understand the power that they get in terms of understanding and optimizing the customer experience with the tools at their disposal (branches, atm's, web, phone, etc).

Andrew: It will totally mess up your page view counts. Of course you can easily filter them out and get clean data.

Also hopefully your site is getting millions of visits and, one can hope (!), that your phone center is not getting millions of calls driven by your site!!! :).

Glen: Excellent point. I think that all our early multi channel efforts tried to seek out exactly those kinds of correlations and ways of validating our hypothesis of how the web might be adding value as a channel.

But I have observed that two things have changed. A lot of the low hanging fruit is gone, so showing impact is a lot more complex challenge. Secondly the executives are demanding much more accountability (beyond what we have shown them in the past, which was better than "trust me this internet thing is a good idea").

We can't quite give them all the accountability, but hopefully some of the ideas in the post allow us to give them more (and for the not so low hanging fruit!). :)

Thanks for the wonderful comments everyone, I have learned atleast four new things just from your comments to this post!

-Avinash.

The insight here is awesome. To truly maximize the opportunities of online marketing you have to track offline, online and long term value (LTV) and that's how you build an incredible marketing platform!!

Thank you for the continued great posts!

Ah, a topic after might own heart! And such a pleasure to read the way you write.

I would maybe want to suggest that, yes a Geek ID rarely exists, but as you describe later on, customer level data does exist. And it exists more often than we think.

The number of online businesses that know the identity of the online customer/browser are not that rare as we often think.

Not only banks know who is logging in online and who is coming into the branch / ATM.

Telcos know exactly who is checking their phone bill.

Do Expedia / Travelocity / Airlines know who is buying / browsing travel? Yes of course! Credit card baby!

Do car rental companies have any doubt who is making a reservation online vs. what their rental behavior is offline? Sure thing.

How about your utility's ability to compare self service logins online to call center calls? The CRM system does log who a call was for, after all.

So there is a lot of customer data. In the online space we are more familiar with aggregate level measurements. But in the relationship marketing world it is much more common to work with customer level data in order to understand behavior across channels. Kevin Hillstrom's method of Multichannel Forensics is one wonderful example.

My pet peeve is always that online and offline guys need to work together. One party has all the data, but the other party has much to teach.

Thanks for another great post!

Akin

– – – – – – – – –

Note: Everyone: Akin is the author of a wonderful book called Multichannel Marketing: Metrics and Methods for On and Offline Success. As the title indicates it is a perfect book for the topic we are discussing here. You want more details on how to do it? He's got them in his book! – Avinash.

Nice Post.

I think the primary key you are after resides in the fact that most purchases are repeat. So you could link the unique visitor cookie to a credit card which would be used both on and offline across purchases.

By knowing and offline website behavior, one can potentially test different calls to action to see if one drives more people into the store than another. Or even with new ad targeting, re target specific offers to get people to come more into a store.

So I'd say tracking unique visitors is great for channel optimization (web->offline)

Where I see it getting really complex is understanding how other channels interplay with each other (say catalog -> web -> store -> comparison shopping engine -> back to store ….) There just seems to be too many "paths to sale" and lots of missing gaps (like hearing about a product from a friend.)

So I would agree that looking at regional tests is a great way to start understanding these connections, there is just a lot of complexity in selecting the right markets and filtering out the noise.

Avinash,what are your thoughts on the following three things:

1. How do you see mobile commerce fitting into the multichannel analytics (both with going directly to mobi sites, Google mobi business pages and via text purchases/coupon redemptions) as these are driven by different buying motives?

2. Companies that keep offline pooled actual transactions from multiple retailers now adding online identifiers and cookies based on a unique database ID? Is that workable for good prediction?

3. Where do you get the wonderful pics you use? I'm sure you've asked that before.

Thanks and great work!

Is there a use for this data that can improve the web site itself, without drawing on more budget resources?

The main "end result" stressed here is just more budget for analysis and the web site. I think there must be some specific improvement that could be made on the web site, but maybe I am just missing it.

Avinash, your blog is wonderful. And so is your book! I'm working through it now.

Interesting and very excellent post! Multichannel analytics is the pandoran box, I agree.

I believe that combining the how many (Web analytics data and quantitative market research findings with why (qualitative market research findings) one is few step further in understanding offline-online-offline lift.

Multichannel analytics is very hard to do. Few points what are important, especially with market research (quantitative and qualitative method):

1. Before launching on a market research survey, one has to ask the question what is my target audience (or population) one wants the survey to be conducted with?

Then, when the population is found ( will it be the recent buyers, customers at age between 18-34, or the hole customer base), one has to allocate the survey sample to be representative to the hole target population. This to make sure one can generalize the survey findings to the hole population. Imagine if your sample has over-representative of people who are just to satisfied customers, your survey findings can then not be used.

Other interesting point with multichannel analytics are the different real life variables, which plays a role on the effectiviness of one's multichannel campaigns.

For example, when it is a nice sunny weather, certainly people will buy more summer clothes one has advertized in www-page, tv, radio, etc. in other channels. But when it is a rainy weather, the buying process is a bit more slow with that summer t-shirt. So how can one effectively measure what impact the weather has on your multichannel marketing campaings?

Certainly one can pull info from WA tools or ask the customers, but on the long run, how effective role statistically the weather has? How about the different economical "rapid climate changes" impacts on the effectiviness on ones multichannel campaing?

So, to wrap it up. Multichannel analytics and tracking offline conversions is certainly very important thing to do, because people do not live in a offline or online word. The mix and use different channels when making purchase decisions. Even though one can measure these different channels, still the variables plays a role as well.

I also totally agree with Avinash, even though we do not have a ready software or process yet to answer on the dilemma of multichannel analytics, this should not stop us trying different ways to solve it! Positive thinking, trying, putting the hours in and sharing information with other analysis experts will eventually leads us towards the solution on multichannel analytics.

Sally: People make a big deal of Mobile, I don't. Of course not from a opportunity perspective (which is huge) but rather from a measurement perspective (mobile essentially is just another clickstream data source, albeit with some current challenges). Answers to your questions…..

#1: The visits could (though not always) be driven by different motives, but as more time passes (i.e. phones and browsers become better) I think they will come closer together. Though you might still wait till you get home to look closer on your home 24 inch monitor at the $900 Manolo Blahnik sandals before you press Buy Now. :)

The challenge with mobile is data capture. We have not quite settled between what data capture mechanism to use (server logs, javascript tags and packet sniffing) and what unique identifier to use (phone number? cookies? what else?). In the next year or so that fight will be settled and we will have just as much insight from our mobile visitors as our websites, and we will have to think of new ways to measure multichannel impact (in addition to the tips above).

#2: I don't see why not, if that identifier is available then your life is heaven in terms of understanding multi channel impact.

#3: Many of the pictures I create myself (about half in this post) and others I get from Google Image Search or free stock photo websites (like http://www.sxc.hu).

Nabha: You are right, you can improve your site from multichannel analysis. Let me give you one example of site improvement through this type of analysis.

We had a site and it was converting (online ecommerce) at a nice clip. But after applying some of the techniques in this post we found that the site was not serving the needs of people who wanted to buy offline very well. When we segmented out website's onexit survey data for those who indicated "retail" as their preferred channel of purchase we found two problems with our site:

1) Most of the people who would buy at a retail store were the new visitors to the site and they wrote that we were using language (text and acronyms and menu names and other terminology) that they did not understand. Turns out that anyone who had already used our software (existing user / customer) would totally get it because all the text was written for them, not for the new customers. Doh!

2) People with the offline channel preference wanted to print the page and take it with them. The css of the page was not optimized to print the page nicely, and there was no "print this page" icon / link. Double doh!

In hindsight these were almost obvious, but not before we got the feedback. :)

Hope this helps,

Avinash.

Hello. AT homedepot.com we do look at traffic to the store locator and direction but, what is more important is the purchase intent info coming from our survey. A visitor may visit our site several times and then decide to purchase so in that case its best to just ask them.

Here's another reason why you ought to be linking online and offline data….Yahoo and ComScore did a study last year that found that "online customers who pre-shop on the web spend more in-store.

Here are the key insights from the study:

– Consumers exposed to online advertising are more engaged: Consumers exposed to display and/or search advertising viewed an average of six more pages during the period in which they were researching compared to those not exposed to advertising.

– Almost 90 percent of the incremental sales generated by online advertising take place in-store:

Consumers exposed to online advertising spent an incremental six dollars in-store for every one dollar spent online.

– Integrated search and display campaigns have maximum impact: Combined search and display ad campaigns resulted in deeper engagement for consumers exposed to those ads, leading to increased sales.

Here's the article:

http://www.comscore.com/press/release.asp?press=1547

Avinash, that was enlighting, really!

I saw a link in a blogroll an hour ago and now I'll definitely add your feed to my reader.

And guess it? A fellow colleague of mine told me of you (and your blog) – months ago, offline. How would you track that blog "conversion"? ;)

Sincere Congrats,

Petro

First, great post. So true. Trying to get metrics from different channels of business marketing is akin to being both mediator and translator at the UN. There's a tremendous amount of valid arguments about important topics, but nobody speaks the same language or wants to give up any ground. It makes getting anywhere extremely challenging both technologically as well as dealings in intra-corporate politics. The technology is young and relatively untested.

Since I've moved over to Wicked Sciences, one of our top priorities has been our Session ForeSite solution which is geared toward exactly this problem. The phone call metrics channel and offline conversion issues for ecommerce companies were close to our heart (having been handed down as initiatives from CableOrganizer). It took months and stretching our imagination but we've finally come up with something we think we can distribute. Getting the solution out for CO was technically a short time frame…but, the adoption model was the second big challenge. The funny thing about cross/multi channel measurement is that it ceases to rely solely on clickstream data and begins to have human discipline issues, or true statistical methods (which, for some people steeped primarily in web analytics are probably completely inconceivable).

Interestingly, when we finally pieced together the means to get the data we were both pleased by the results of the technology, and its value testing versus our investment. Even more pleasing were the periphery and tertiary findings both quantitatively and qualitatively related to user experience. The way to get to measurement of the many ways in which users interact with your message is highly challenging and complicated, difficult to corner and rely on….but, when you get there, and you have a solid idea of where and why certain pieces resonate with your audience, the insights are breathtaking.

Now the bad news….despite all our research and countless hours pondering how to make multichannel (phone calls/offline conversion) KPIs visible and reliable, its a very difficult piece to discuss and achieve functional regularity. If the politics associated with web analytics and business intelligence reports and insights weren't tough enough, imagine the impact that THIS data is going to have on the management. Nobody really enjoys the idea of being measured and this, in essence, becomes the equalizer. Suddenly, we're looking at data that tells us about usability and navigation issues on the website, customer service representative performance, shipping preferences (in qualitative terms) and much more about where the rubber meets the road on user experience as it translates to top and bottom line growth.

Let me preface my comments by saying our commerce is both online and direct sales channels with a high price tag and long selling cycles.

Just wanted to mention that we are lucky to have a good amount of our site traffic that has a unique key to tie online to offline, but the complexity doesn't stop there. If you have a specific question than you should be fine, but using web traffic data at a macro level to add visibility to customer/contact behavior is more complex because of the granularity of online data. You can't just map every URL that person has visited to their customer record. This is too much data to get intelligence from. We have been for some time trying to get the right mix of what to map. Here is our brainstorming list:

1) Use a search tool backwards to get the "keywords" or essence for the visit

2) Only match selected visit "events" such as looked at a video

3) Only have high-level when the person visited and maybe number of page views

Have you ever heard of anyone doing #1?

This post is a tour de force Avinash! I think it's especially relevant for those of us in the nonprofits sector. Much of our best work happens offline, though we're all trying to use our sites to make those offline interactions even more impactful for our stakeholders and clients. Many organizations see their web sites as primarily fundraising tools and measure the value by the number of dollars raised. Clearly, however, our sites also bring services to those who need them and bring people to our organization in other ways, Measuring that programmatic impact is the Holy Grail!

You've given us some great food for thought about how to get started.

damn I love your posts!!! always worth a close read. agree with your points almost completely.

my company is doing innovative work matching up online consumers with offline purchase behavior. then SCORING our consumers on several dimensions (all connected to purchase) to enable better development of experiences and interactive marketing programs.

so, I thought we had it all together but your post has given me several new, easy ideas for improving our efforts. thank you very much.

Ave Avinash ;)

Great post, as usual!!!! You made me think about my first approaching to WA. We didn't have any sophisticated tool so I had to look directly to the logs. But I had a specific key which told me who had been trying to buy something and didn't do it finally (I used to get the url where I knew most of the clients dropped off the process of purchasing).

I just had to cross that key with our CRM datawarehouse and check out if some of them had finished the process somewhere else (phone or store). I learned one simple thing. Around 40% had finished the process but not in internet. Why? It could be something about age (are they older than 50 yo?), about gender (more women than men), about money (the richer, the "interneter")… but sometimes the only thing that worked to explain why they didn't finish the process was that the process was a mess!!!

Amazing, I enjoyed analyzing all these things even if it was a real pain to get the data.

Now everything is easier, is even fun :) but I will never forget that start… I feel so old when I say this kind of things :)

Thanks, Avinash, it's a pleasure reading you. Always.

Un abrazo!

Hi Avinash,

Great, comprehensive post on tracking non-line outcomes. Here's another one that I've been having fun with since about 2002…

We can track the "Impact" of on-line to off-line by getting clever with channel contact strategies. I have run about 30 A/B tests with clients where we send out an email solely to "sensitise" people to the imminent arrival of a big, expensive off-lne contact moment (mail or phone), and we are tracking success by the uplift to the off-line piece.

Regularly see improvements of up to 40% for direct mail response and have had a whopping 78% improvement for an email to "soften up" a cold telemarketing call (then it's not so cold, and works better, see?). Successful outcome is either getting more of a segment to respond (most valuable, high profit customers), or to get more conversions for less (enabling us to mail deeper into un-responsive files).

20% uplift to direct mail at 2% conversion (taking it to 2.2%) will reduce Cost Per Response by 15-20% including incrementation cost of email. Big win, quick win, sustainable win. Everybody wins!

Keep up the great blogging!

David

Hi Avinash,

Fantastic post. I may be slow at getting around to reading these, but they are always tremendously useful. I've checked out your suggestions for handling phone contacts, and it looks very promising. I know that this blog is geared towards larger sites, but I generally work with much smaller sites (10-100 visitors a day), and measuring the impact of brochure sites where there is no e-commerce capability and there is a small sample size of visitors has always been a challenge. I think it's interesting that most of these companies "know" that they need a new website every few years, but quantifying the value that they derive from it is a major challenge, especially when you are generating leads for complex products that have high value. Take a custom programming outfit, for example. One lead that converts into a $50k sale (potentially 10x that much in lifetime value of the customer, even without factoring the value of referrals) can justify a lot of web work, but you may only get one a year! My clients struggle (as do I) to quantify the web work that they received and how much of it is related to this one magic lead. This is a more extreme example, but it is not that uncommon. My world is one of very small sample sizes, and separating out the signal from the noise is a constant challenge. Any advice on this would be much appreciated.

On a slightly different topic (this is what I get for posting at 1:11am!), I've often wondered if there are ways to quantify the quality of a website for visitors that do not perform an action that is immediately trackable (call/email). Sort of the equivalent of the good will that someone buys in a company acquisition (obviously an imperfect analogy). For example, I had a client recently tell me about someone who came into their office and said: "Your website was far and away the best of all the companies that do [service] in [location]! This is the only reason I picked your company." You can't get much better press than that, but I'd love to know if you can measure that more actively instead of hoping a visitor tells your client and that your client tells you. Any thoughts?

Thanks again for the great post – sorry for the rambling, long-winded comment :)

Cameron

Hi – we've recently launched a buyer's guide for foosball tables where we are driving online researchers offline to brick and mortar stores to purchase tables.

We are charging retailers a fee to place an ad, consumers enter their zip/postal code to "find a retailer" near them to shop.

My question(s):

How do we track the consumer from viewing the ads to making a purchase?

I guess that's the main one – I am a newbie in this arena – an expert on foosball but not web marketing.

Any help is most appreciated!

Ken

You have to have some sort of unique identifier. For example and unique coupon code so that buyer can take it and redeem at the store.

This is indeed an interesting discussion.

We are using a very effective method for offline-tracking by combining innovative advertising media in the POS / instore media section with QR-Barcodes.

The challenge is to 1st make sure that your clients' brands and product stand out from the crowd through the display of 3D Floorgraphics by german advertising company Shapeshifter Media and to print a QR-Barcode (can be scanned with your mobile phone and leads you to your client's landing page online) on it.

This way the POS campaign proves both highly effective in actual sales and has added value for both the end customer and your client.

Handing out free samples for the people who scan the ad, building online communities through the display of this 3D ad or just simple tracking of your offline campaign – we were simply stunned by the new opportunities that this method gave us.

cheers,

Florence Graham

Excellent post. Did anyone test the impact of SEA on offline/retail sales measured thru GfK or NPD data?

Let me expand on my question posted above. Based on ROPO (Research Online, Purchase Offline) research, it has become evident that for certain product categories, such as consumer electronics, buyers are using for a large part using online sources such as search engines and manufacturer websites to inform them selves and even make their purchase decision online, whilst still buying through traditional channels such as retailers.

Especially when product manufacturers do not own retail stores, it is hard (not impossible) to measure the relationship between those online sources and the actual sell-out thru retail. Market research companies, such as GfK (for Europe) and NPD (for US) report on sell out in retail.

Therefore, my question is: how can retail sales be linked to Search Engine Advertising campaigns based on the data published by research companies?

Martin: I am unsure of what "ROPO" research you are referring to. I think there have been a bunch of studies that show that things move both ways. Offline drives and online drives offline.

IMHO it is increasingly not dependent on the product category (used to be) but rather the value proposition. For example I would never buy shoes online but Zappos closed the year with a billion dollars in sales online. So on and so forth.

We have done specific controlled experiments where search spend increased in store sales of mattresses and, in another case, applications to the University.

My recommendation: Chuck the "research" in the "will not trust generic opinions without trying it myself" pile and try it. There are a bunch of ideas in this post. I am sure you have others.

Good luck.

-Avinash.

PS: If it is of some value here is a post about tracking online impact of offline campaigns:

Multichannel Analytics: Tracking Online Impact Of Offline Campaigns

Does anyone have a general estimate, or specific reference preferably, to an avg conversion rate of broadcast ads converting to website traffic in comparison to online ads? Something like '…online ads converted on average 3x that of broadcast ads, in regards to generating website visits'?

Great post Avinash! From the perspective of tracking how well offline marketing campaigns deliver visits to a website I thought I'd share a little tip I have used in the past.

Register a new domain name which includes your companies brand name and a keyword relating to what you sell (e.g. brandname-widgets.com), and use that as the URL in a single specific offline marketing campaign. This 'pseudo-URL' should have a redirect set up to your standard business URL (e.g. brandname,com).

To see how much traffic the offline campaign delivers to your website you simply need to run a segmented report based on the amount of traffic referred to it from brandnamewidgets.com. This can be a great insight as to how much ROI an offline campaign can deliver via your online channels.

Some may say there is no need to create a brand new 'pseudo' URL, as using an existing business URL with a subdirectory will do the job just as well. However I would argue that people may just type in 'brandname.com' to get to the website and forget the trailing '/subfolder' completely. By having a distinctive '.com' URL in the advert it forces people to enter that exact URL to visit the website without the risk they may leave an important part – the tracking part – off it.

I used this technique to track the effectiveness of an advert my previous employer ran in The Times. Over the course of a month, at around £500/week advertising costs, we discovered the newspaper had only delivered around 30 unique visits to the website – a very valuable insight!

I'd like to use the Hope sign image for my twitter profile image. Is the image copyrighted? Do I need permission from you?

Thanks, Wilma

This is indeed very interesting.

I usually do the other way around, I check how much the offline presence is affecting the online one (which is much much easier of course).

I think I will read the post 10 times to get every info out of it, it will add for sure a great value to my SEO campaigns!

Thanks

Marco

Sad to hear Border Bell didn't make it. :(

On a more serious note, however, this is indeed a great post. I'm not quite sure how I stumbled across it, but I read the post in its entirety before looking at the date — and was surprised to see it was written about 2 and a 1/2 years ago; in my opinion, the content is as relevant today as it was back then.

You had hoped things would be easier to track in a few years — and right now it's technically a few years later. I'd love to hear your thoughts on what progress and advancements in offline tracking has exceeded your expectations…

Erin: Many things have become easier. For example there are lots of programs that will automate adding tracking parameters, it is so much easier to do phone call tracking (and with a lot of detail), unique coupons is a bit easier, surveys are faster. More things like that.

But there has not been a revolution. It is still a slog to do this right, but when has that stopped the motivated? :)

Avinash.

Hey Avinash,

I know this post is pretty old now so I'm assuming it's just a case of how Google's algorithm has evolved over time but wondered if you would comment on your previous recommendation about the use of unique freephone numbers on the web for tracking purposes. From a local search point of view this is something that generally is recommended against now isn't it? From articles I've read, the general consensus is that Google's Local search algorithm likes to see consistent business listing citations (i.e. same phone number wherever mentioned) plus it also prefers a local phone number. All of which makes tracking that bit harder!

Would be great to hear your thoughts.

Nick: I don't have any unique insights into Google's Search Algorithm compared to any one else in the field.

But using unique phone numbers for tracking purposes is no different than changing the color of the Add To Cart button to appeal to different demographics. Or making very small changes to the copy to different segments by country (or source or whatever).

If you are worried about the local business listings then only use unique trackable phone numbers on your core landing pages or campaign experiences. Search spiders typically don't index those content (as the entry points are off campaigns only) and that might be a way to mitigate your worry, and solve for all parties.

-Avinash.

Avinash,

Got any quick reco's on good companies that provide DNI tracking? We're a very large retail organization, and we want to track all of our phone orders. We'd like to know who got what number from where before they called, so that we can attribute that value to the appropriate source.

Thanks!

Online to Offline & Offline to Online are both the following the same strategy. In Offline impacts for Online campaigns, we need to define our requirements to meet offline needs, but in Online impact for Offline campaigns, we have to follow the defined requirements to track online delivery.

Hi Avinash!

The link : "Offline Phone Call Tracking With Web Analytics Integration." leads to an empty page :)

Alexander: Thanks for pointing this out.

Fixed now!

Avinash.

Like the coupon tip; Fortunate 500 companies do that for a reason!